Lithium, graphite, nickel… Europe relaunches its industrial strategy for critical raw materials, from extraction to recycling

In March 2024, Europe adopted regulations on critical raw materials, known as the Critical Raw Materials Act. It lists metals that are of great economic importance to the European Union (EU) and pose a high risk of supply disruption. The text sets ambitious targets: by 2030, 10% of critical raw materials must be extracted in Europe, 40% processed, and 25% recycled.

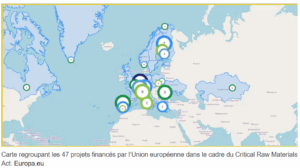

One year later, it published 47 industrial projects that will receive financial support. The members of the G7 issued a joint statement on these issues. But is this ambition enough to make up for a 20-year lag behind China, effectively secure supplies, and strengthen energy sovereignty?

Jean-Baptiste Colbert, Baron of Seignelay and Sceaux, was born on August 29, 1619, in Reims and died on September 6, 1683, in Paris. MorphartCreation/Shutterstock

Jean-Baptiste Colbert, Baron of Seignelay and Sceaux, was born on August 29, 1619, in Reims and died on September 6, 1683, in Paris. MorphartCreation/Shutterstock

Jean-Baptiste Colbert (1619-1683) was Comptroller General of Finances in 1659 under Louis XIV. He quickly realized that France could not catch up with England and the Netherlands, which dominated world maritime trade, in terms of shipbuilding without a massive transfer of technology and strong support for national industry. A key principle guided his policy: comprehensive management of the shipyard value chain. This had to include organizing the supply of raw materials, optimizing flows at each stage of the chain (selection of wood, steel), and integrating the best construction techniques. All this while ensuring the sustainable management of forests for the supply of quality wood, as evidenced by the 1669 Water and Forestry Ordinance. Colbert also devoted much of his efforts to developing the tin and materials industries essential to armament, as well as the logistics of these materials.

One of Colbert’s main priorities was to promote manufacturers that had become national industrial leaders by encouraging their development through various incentives: subsidies, tax breaks, customs barriers, and training assistance. This Colbertist model continues to influence contemporary industrial policies. In the 1990s, the national strategy for the development of the telecommunications sector was described as “high-tech Colbertism” by economist Élie Cohen. This debate is still very much alive today.

Critical metals and materials are part of our everyday lives. Among the 34 metals listed by the Critical Raw Materials Act, lithium, graphite, nickel, manganese, and cobalt are essential for electric vehicle batteries, silicon for solar panels, and rare earths, such as neodymium, are used in wind turbine magnets, motors, and telephones.

Extracting these metals is complex, energy-intensive, and water-intensive, and refining them involves the use of polluting products. These metals are produced through several metallurgical and chemical processing operations. After extraction, the ore is crushed and then concentrated by physical separation, flotation, or magnetic separation. The resulting product is refined by chemical or electrolytic purification. Refining requires a specific treatment process for each metal: acid hydrometallurgy for lithium, pyrometallurgy or hydrometallurgy for nickel depending on the type of ore, solvent extraction or grinding for rare earths, and flotation for graphite.

The metals obtained are transformed into semi-finished materials such as cathodes and anodes, permanent magnets, or lithium salts. These materials are then assembled into finished products, such as lithium-ion batteries for electric vehicles. The various stages of the value chain are located in several countries.

Lithium, cobalt, and nickel are mainly extracted in Chile, the Democratic Republic of Congo (DRC), and Indonesia. They are largely refined in China, which accounts for more than 50% of global refining. China has a monopoly on the processing of rare earths and lithium and the extraction of graphite. The transformation into industrial materials for assembly is concentrated in Asia. The slightest contingency (armed conflicts, embargoes, landslides, earthquakes, etc.) can quickly create risks of supply disruptions.

In just a few decades, China has established undisputed dominance over mineral value chains through a strategy of state and industrial investment. It has adopted a proactive acquisition policy. Unlike Western countries, which have long outsourced their supply, China has systematized the direct purchase of mines in Africa, in the Democratic Republic of Congo (DRC) for cobalt, and in Zambia for copper. In Latin America, Chile and Bolivia for lithium, as well as Indonesia for nickel.

Large Chinese groups, such as CATL and Sinomine, obtain mining concessions or enter into exclusive supply contracts with the support of the state. Bolivia recently announced the signing of a $1.4 billion investment contract to develop two mines and two lithium production plants with two mining companies, Citic Guoan (China) and Uranium One Group (Russia), both of which are supported by their respective governments.

Logistics completes this strategy. China is deploying a vast global network via the new Silk Roads Belt and Road Initiative. By financing infrastructure in Africa, Asia, and Latin America, it is securing its supply chains and strategic trade routes. It recently offered the European Union a green channel for its rare earth exports, increasing the dependence of partner countries on its infrastructure.

The expression “Chinese Colbert,” which appeared after Deng Xiaoping’s death in 1997, takes on its full meaning today. Like Colbert in the 17th century, Deng Xiaoping structured a strategically-oriented state capitalism.

The European Union depends mainly on imports from outside the EU for its battery and motor value chain. China accounts for nearly 100% of the EU’s supply of heavy rare earths and 97% of natural graphite. 80% of lithium is extracted from mines in Australia, Chile, Argentina, and China. Processing takes place in China. Nickel is mainly extracted from mines in Indonesia (more than 60%), and more than 70% of cobalt comes from the DRC.

The 47 strategic projects selected by the EU represent an estimated investment of €22.5 billion. They aim to strengthen the European value chain for critical metals and materials and diversify its sources of supply. These projects are dedicated to extraction (including two in France), processing (five in France), recycling (two in France), and raw material substitution. The scope covers lithium, nickel, cobalt, manganese, and graphite for battery manufacturing. With strict guidelines on compliance with environmental, social, and governance (ESG).

These projects will benefit from easier access to financing. The G7 summit held in Canada from January 1 to December 31, 2025, announced massive investment partnerships. Private capital will undoubtedly remain difficult to mobilize until the mineral value chain is recognized as an environmentally sustainable activity by the European green taxonomy.

Without complete control and significant relocation of the refining and processing stages, Europe’s industrial sovereignty over critical metals will remain incomplete, and its gigafactories vulnerable. This is the “missing link” that must be built with the utmost vigilance.

The relocation of battery factories to Europe currently only provides partial sovereignty. They remain largely dependent on critical metals, which are extracted and processed outside Europe. The challenge goes beyond the construction of factories. Recent projects launched in Europe aim to control the upstream stages of final manufacturing and fill this gap.

Europe is also being forced to consider strategic storage mechanisms. The United States, Japan, and China are building up strategic stocks. China continues to increase its reserves through massive investments abroad to maintain its dominant position in the face of the protectionist shift initiated by the United States. However, for Europe, the usefulness of these stocks depends above all on secure resupply and relocated refining capacities. It is clear here that the issue of storage cannot be separated from a more global control of the value chain.

Europeans are focusing primarily on recycling, which remains hampered by economic and technical obstacles: costly processes, low profitability, poorly structured sectors, high purity requirements, and low recovery rates. According to the International Energy Agency, recycling will play an increasingly important role, particularly for lithium and cobalt. However, primary production will remain essential in the medium term, as the volumes of batteries to be recycled will only become significant in 15 to 20 years‘ time, when the batteries manufactured today reach the end of their life.

These advances must contend with the social and environmental acceptability of mining projects for the energy transition. This factor remains a stumbling block and a source of mistrust towards projects targeting critical and strategic minerals, including their refining and even recycling. Highly publicized opposition movements have led to the abandonment of certain lithium extraction projects, notably that of the Rio Tinto group in western Serbia, or continue to raise doubts and protests, as in the case of the lithium mine project in Allier, France.

In general, the strengthening of environmental requirements or the reference to labels such as “responsible mining” or IRMA and the promotion of sustainable extraction standards are a definite step forward. The increase in costs associated with these actions risks weakening certain links in the chain compared to Asia. The G7 is calling for greater transparency in the supply chains of critical minerals and diversification of resources and, above all, for better coordination among its members in the face of market disruptions.

Renewable energies are often accused of destabilizing the power grid. Artificial intelligence tools can be used to locate photovoltaic installations, ...